CreditBoost

Gamifying Credit Health

The Observed Problem

Users aren’t getting support from credit platforms to successfully change their habits to increase their credit scores. Credit information is complex, confusing, and unmotivating. This can cause users to make less informed decisions, feel the app is untrustworthy, and may lead to users quitting the app.

My Role

Product Strategy

User Research

Interaction

Prototyping

User Testing

Illustration/animation

The Hypothesis

Gamifying credit information could help users increase their scores more effectively and therefore make the app more successful because it can:

Increase user engagement. Gamification elements such as badges, leaderboards, and rewards can make learning about credit and improving your credit score more fun and engaging. This can lead to users spending more time using the app and taking more steps to improve their credit scores.

Make it easier to understand and apply credit knowledge. Gamification can be used to break down complex credit concepts into smaller, more manageable tasks. It can also provide users with real-time feedback on their progress and help them identify areas where they need to improve.

Motivate users to take action. Gamification can be used to create a sense of competition and camaraderie among users. This can motivate them to work harder to improve their credit scores and achieve their financial goals.

Link credit choices directly to credit scores. Gamification can break down complex credit concepts into smaller, more manageable tasks. It can also provide real-time feedback on their progress and help them identify areas where they need to improve.

Decrease Financial Anxiety. Gamification focuses the user on manageable and short-term tasks. Control is key in reducing anxiety.

In addition, a credit app with a gamified user experience is likely to attract and retain more users than an app with a traditional user interface. This is because gamified apps are generally more engaging and enjoyable to use.

What is gamification?

Gamification is the process of applying game-design elements and principles to non-game contexts. It is used to motivate and engage users by making activities more fun and rewarding.

Gamification can be used in a variety of ways, such as to:

Increase user engagement

Encourage users to learn new skills

Motivate users to complete tasks

Improve user satisfaction

Promote brand loyalty

When done well, gamification can be a powerful tool for motivating and engaging users. However, it is important to use gamification elements in a way that is relevant to the user's goals and that does not compromise the quality of the experience.

Here are some tips for using gamification effectively:

Make sure that the game mechanics are relevant to the user's goals.

Use game mechanics that are appropriate for your target audience.

Don't sacrifice the quality of the experience for the sake of gamification.

Make sure that the game mechanics are balanced and fair.

Provide users with regular feedback on their progress.

Reward users for their achievements.

By following these tips, you can use gamification to create a more engaging and rewarding experience for your users.

Initial Research

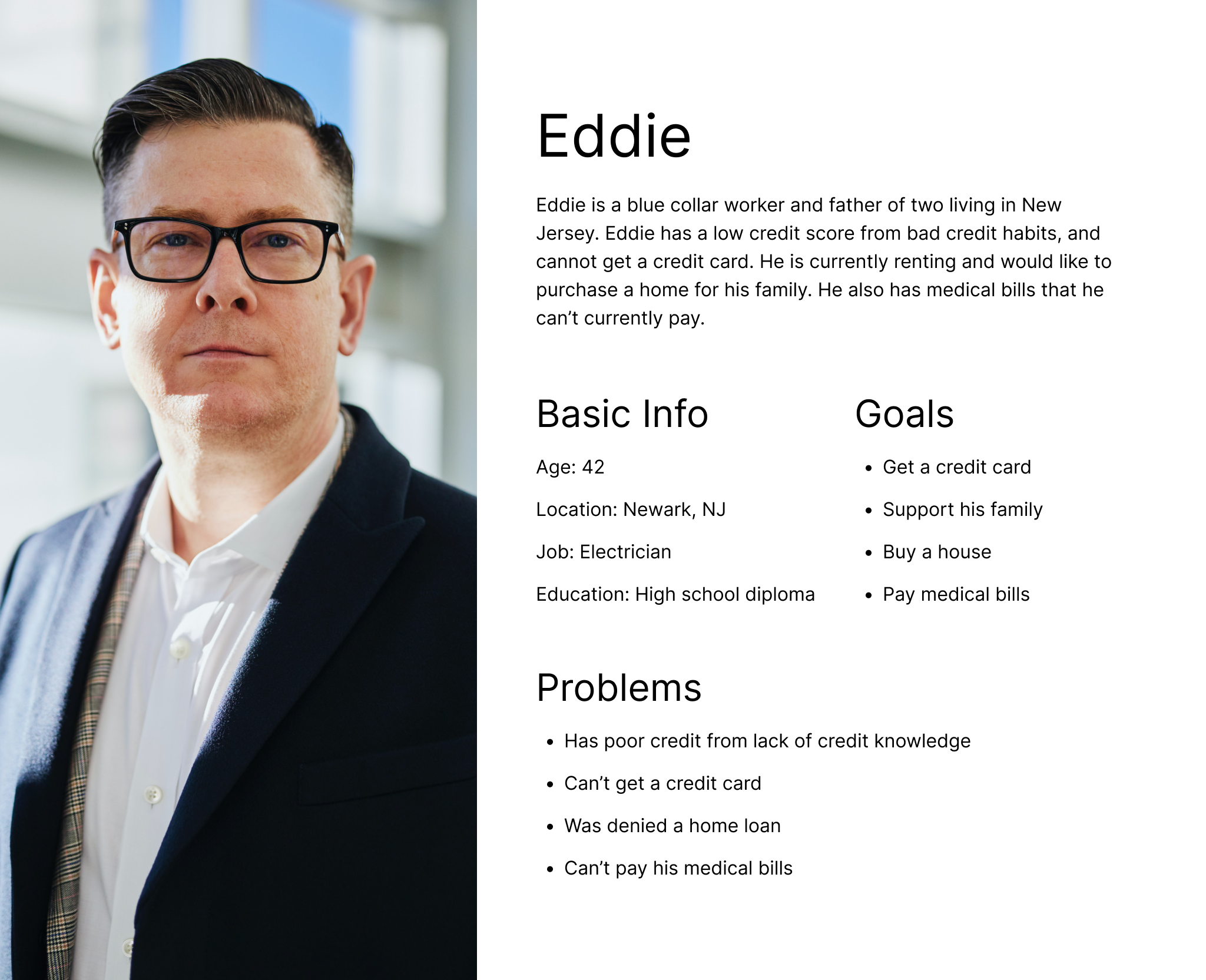

My first step is always finding out who I’m designing for. What are their needs? What are their problems? In this case our users fell into three categories:

Millennials and Gen Z: These generations are more likely to be interested in gamification and mobile apps.

People with low credit scores: These people may be particularly motivated to improve their credit scores, and gamification could be a helpful tool for them.

People who are new to credit: These people may need more education about credit and how to improve their scores. Gamification could be a fun and engaging way to teach them about credit.

Credit-anxious users: People who are worried about using or gaining credit could benefit from the seeing credit through a game lens.

Competitive Analysis

Who is doing gamification well and why?

Duolingo: Duolingo is a language learning app that uses gamification elements to motivate users to learn new languages. Users can earn points and badges for completing lessons and practicing their language skills. They can also compete against other users on leaderboards.

Khan Academy: Khan Academy is an educational nonprofit that provides free online courses on a variety of subjects. The app uses gamification elements to make learning more fun and engaging for users. For example, users can earn mastery points and badges for completing lessons and exercises. They can also compete against other users on challenges.

Habitica: Habitica is a habit-building app that uses gamification elements to help users stick to their goals. Users can create a character and earn experience points and gold for completing tasks. They can also use their rewards to buy items for their character or to unlock new features.

Forest: Forest is a productivity app that helps users stay focused on their work by blocking distracting apps and websites. Users plant a tree in the app when they start a session. The tree dies if they leave the app, but it grows and rewards users with coins if they stay focused.

Mint: Mint is a financial planning app that helps users manage their finances and achieve their financial goals. The app uses gamification elements to make budgeting and saving money more fun and engaging. For example, users can earn badges for completing financial tasks, such as setting a budget and saving money.

These apps are all successful because they use gamification elements in a way that is relevant to the user's goals and that makes the app more fun and engaging to use.

Here are some of the key things that these apps are doing well:

They are using game mechanics that are appropriate for their target audience. For example, Duolingo uses bright colors and cartoon characters to appeal to its target audience of young adults and children.

They are not sacrificing the quality of the experience for the sake of gamification. The apps are still informative and helpful, even if they are gamified. For example, Khan Academy provides comprehensive lessons and exercises on a variety of subjects.

They are using game mechanics to motivate users to take action. For example, Habitica rewards users with experience points and gold for completing tasks. This motivates users to stick to their goals.

They are providing users with regular feedback on their progress. For example, Forest shows users how much time they have spent focused on their work. This helps users stay motivated and on track.

They are rewarding users for their achievements. For example, Mint gives users badges for completing financial tasks. This rewards users for their efforts and makes them more likely to stick to their financial goals.

User research

In order to test the hypothesis we needed a trial group of users and a control group. The participants were chosen based on their credit status and loan approval likelihood. We would be following these specially chosen individuals through their credit journeys to see which (if any) gamification methods were motivating the educating users.

Research Question: How can gamification be used to motivate people to improve their credit scores?

Participants: 15 participants who have expressed a desire to improve their credit scores.

Procedure:

Participants will be recruited through online and offline channels.

Participants will be randomly assigned to either the gamification group or the control group.

The gamification group will use our app design that uses gamification techniques to motivate users to improve their credit scores. The control group will use our traditional credit app that does not use gamification.

Both groups will be given the same information about how to improve their credit scores.

Participants will be asked to use their assigned app for 6 weeks.

At the end of the 6 weeks, participants will be asked to complete a survey about their experience with the app and how it impacted their credit score.

Data Analysis:

The data from the survey will be analyzed to compare the two groups. The analysis will focus on the following areas:

Motivation: How motivated were participants to improve their credit scores?

Engagement: How engaged were participants with the app?

Effectiveness: How effective was the app at helping participants improve their credit scores?

Conclusion:

The research will provide insights into how gamification can be used to motivate people to improve their credit scores. The research findings can be used to develop more effective gamified credit apps and to help people improve their financial health.

How to design a rewarding UI

A key part of gamification is reward the user through visual cues. So how do we make a credit report visually appealing?

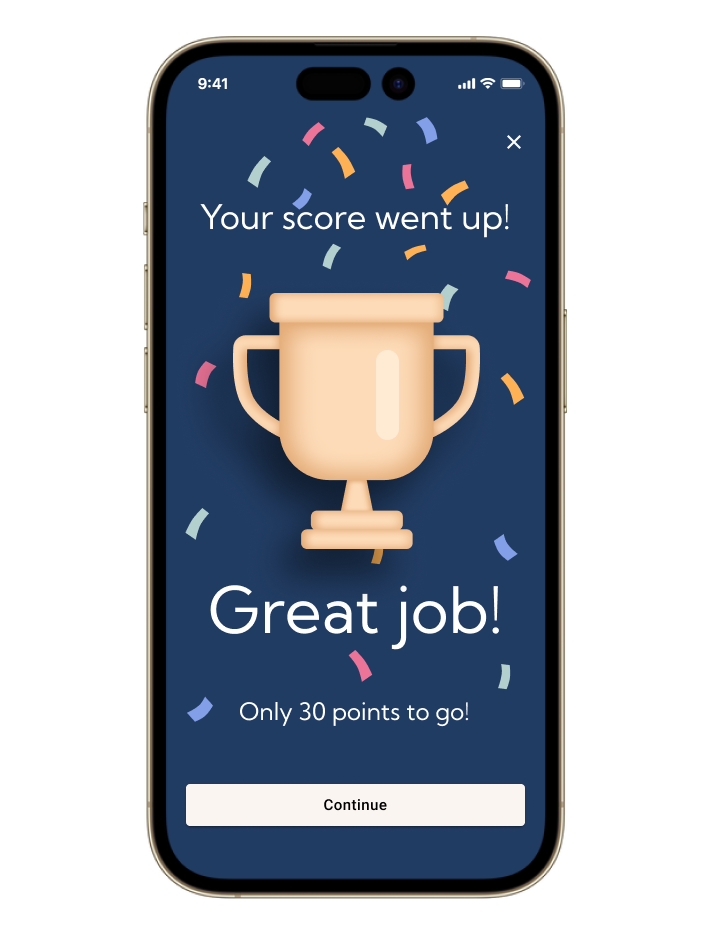

Using positive reinforcement. When users complete tasks or achieve goals, provide them with positive feedback, such as badges, points, or messages of congratulations. This will help them feel good about their accomplishments and make them more likely to keep using the UI.

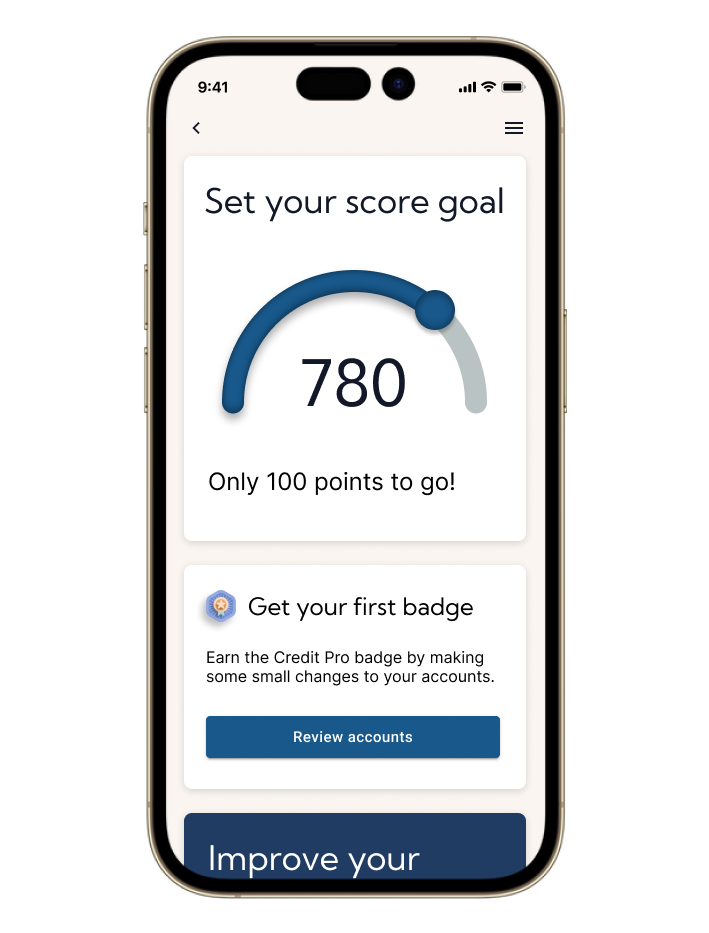

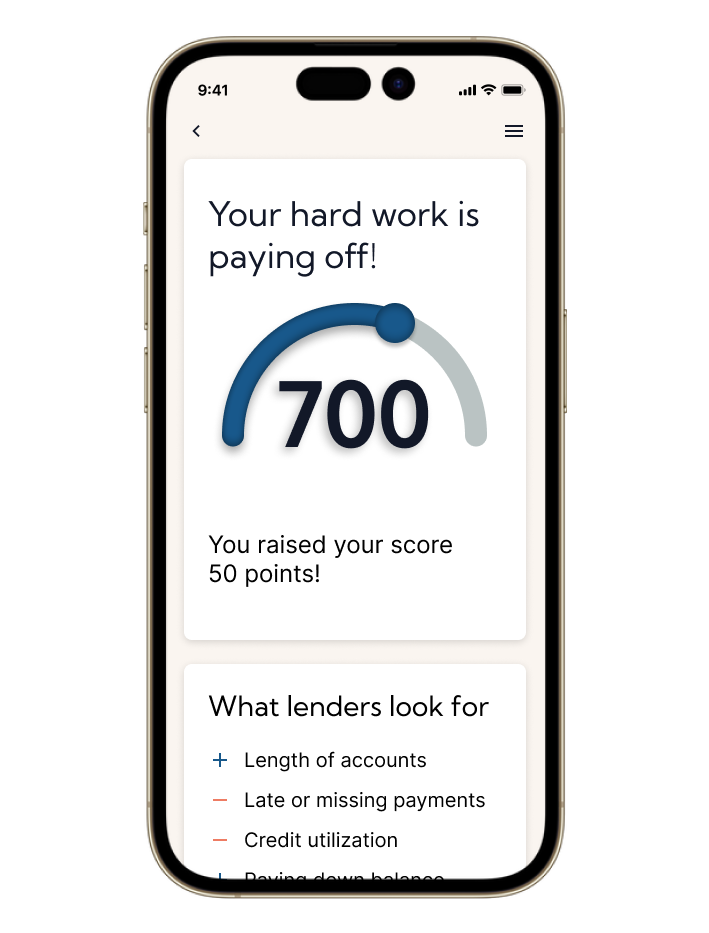

Making progress visible. Users should be able to see their progress towards their goals in a clear and concise way. This will help them stay motivated and on track.

Providing challenges and rewards. Give users challenges to complete and rewards for doing so. This will make the UI more engaging and fun to use.

Making it easy to use. The UI should be easy to understand and use, even for novice users. This will help users avoid frustration and make them more likely to stick with the UI.

Personalizing the experience. Tailor the UI to the individual user's needs and preferences. This will make the UI more relevant and engaging for each user.

You can see how these techniques are used in the ideation process below.

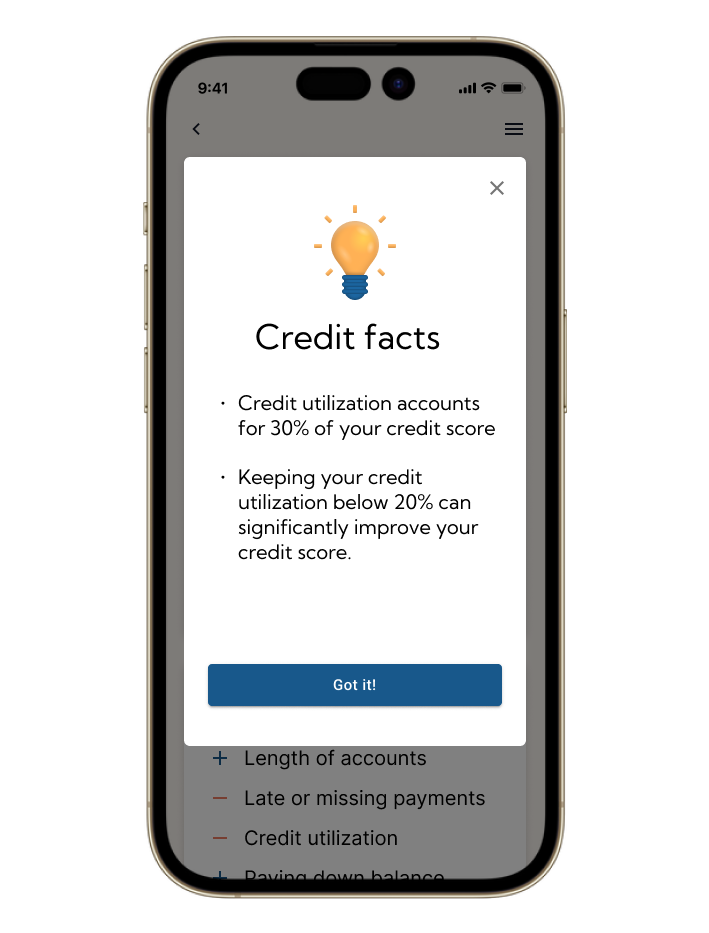

Ideation #1: Condense credit education into easy-to-understand portions

Credit information is famously confusing and dry. We decided to test different ways of providing credit education to users. By giving users small, concise portions spread over multiple uses we found credit knowledge went up almost 30% and retention went up 45%. Gamified credit quizzes also had great results in testing, but didn’t end up in the MVP.

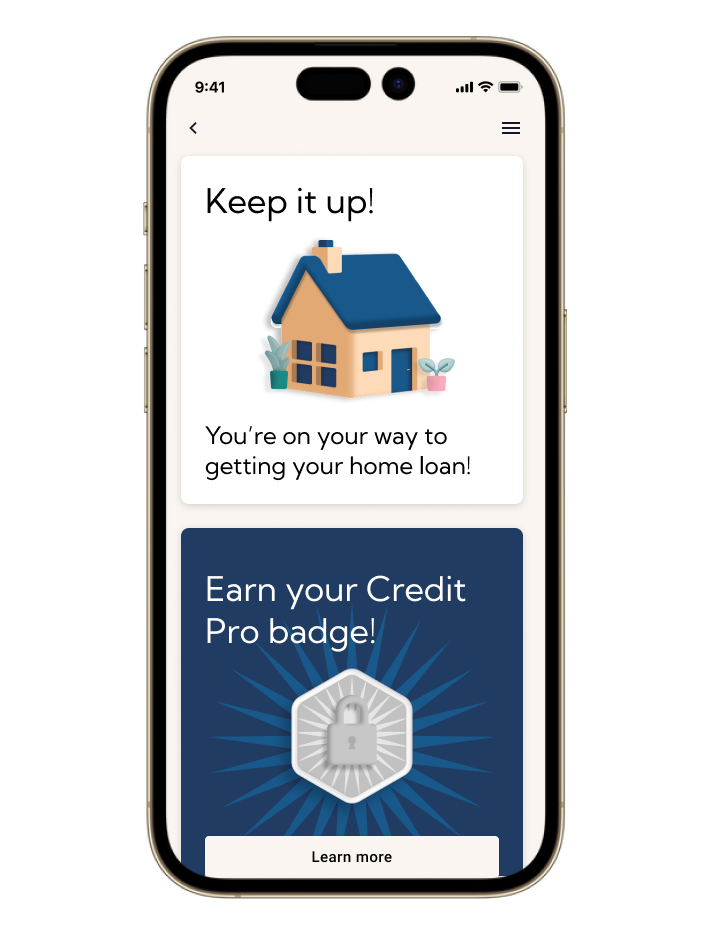

Ideation #2: Badges

Badges are effective in gamification because they provide users with instant gratification and recognition for their accomplishments. When users earn a badge, they feel good about themselves and are more likely to continue using the gamified system.

Badges are also effective because they are visually appealing and easy to understand. Users can quickly see what badges they have earned and how they can earn more. This makes badges motivating and keeps users engaged.

Ideation #3: 3D illustration and animation

These are effective in motivating users because they can create a more immersive and engaging experience. When users see animated graphics, it can help them to better understand the content and feel more connected to the experience. This can lead to increased motivation and engagement. It can also create a sense of wonder and excitement to a normally dry process.

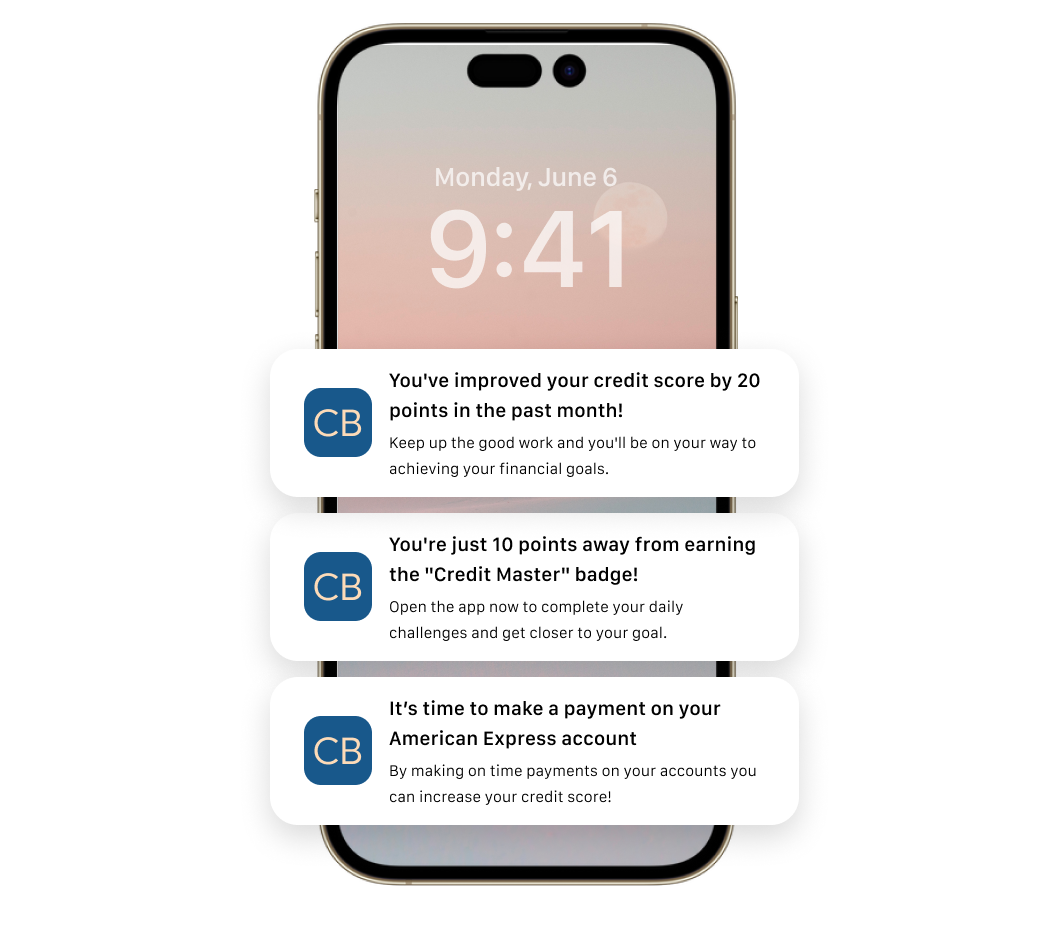

Ideation #4: Reminder Notifications

Motivating push notifications and reminders can be a valuable tool for helping users achieve their goals. By reminding users of their goals, encouraging them to take action, providing social support, and making achieving goals more fun and rewarding, push notifications can help users stay motivated and on track.

Ideation #5: Rewards

By working with our corporate partners we were able to offer users perks for reaching their milestones. Offering real world rewards like credit towards food delivery or local activities were added to the MVP to add a sense of instant gratification to milestones. This helped users stay motivated and made them more likely to achieve their credit goals.

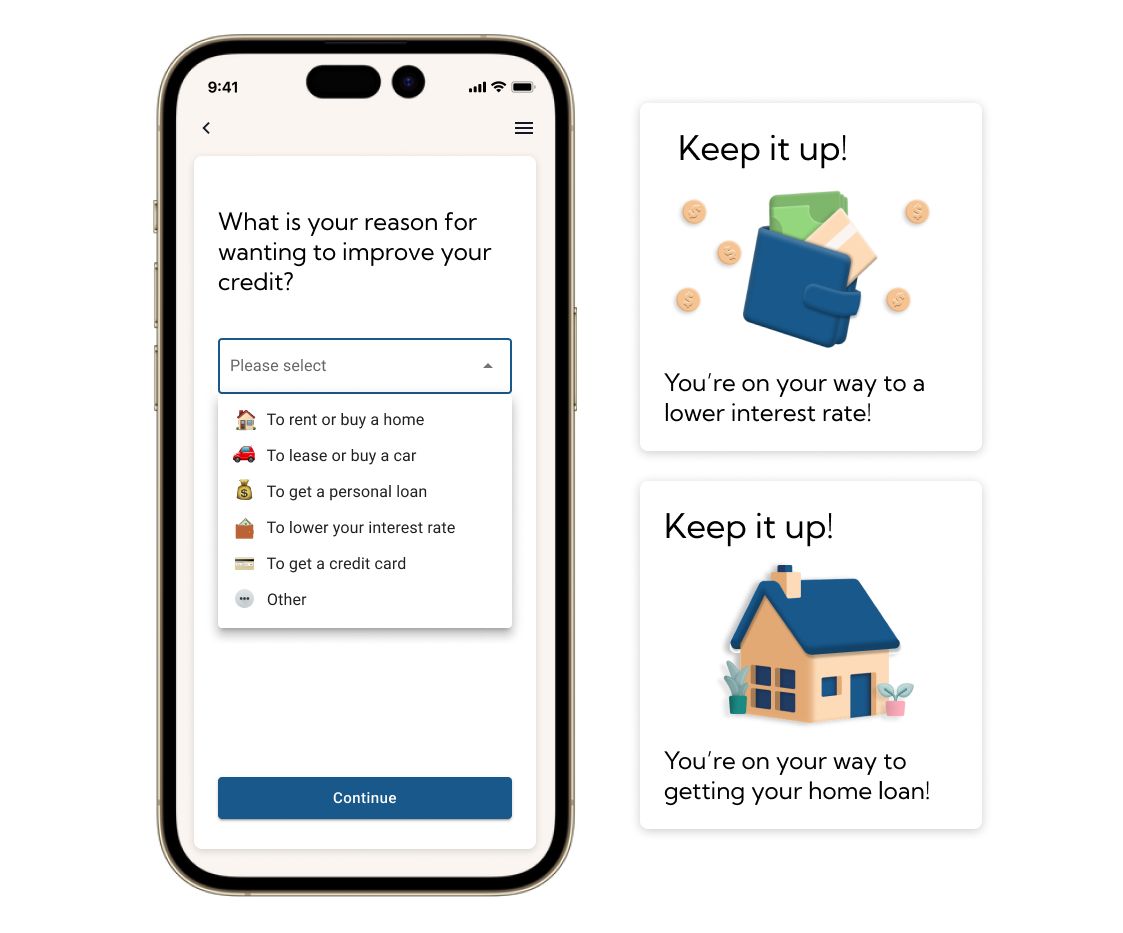

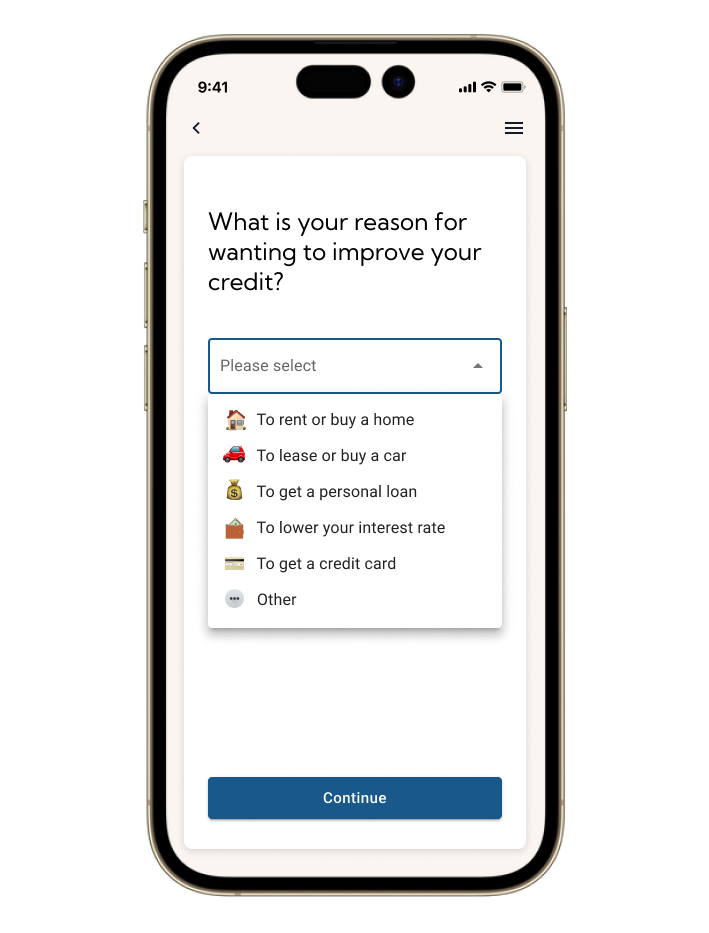

Ideation #6: Remind users of real life goals

When users have a specific goal in mind, they are more likely to stay motivated and take action to improve their credit score. For example, a user might set a goal to improve their credit score by 50 points in 6 months. This goal is specific, measurable, achievable, relevant, and time-bound. This type of goal is most likely to be effective in motivating the user to take action.

Feedback and iteration were essential parts of the gamification ideation process. By collecting feedback from users early and often we were able to quickly change direction based on user input. The result was a collection of ideas and designs that were tested and perfected. This process also gave us the ability to narrow down what features would make a successful MVP, while backlogging the features that can come with future iteration.

The results

The gamified version of the CreditBoost app helped participants improve their credit scores more than the control group. In the end the study found that those who used the gamified experience improved their credit scores by an average of 50 points, while the control group only improved their credit scores by an average of 10 points.

In addition to the increase in credit score, the study participants with the gamified version of the app also did significantly better on tests about credit health knowledge. The average score for those using the gamified version was 84% while the control group had an average score of 63%.

Engagement was also higher amongst participants that used the gamified version of the app. They opened the app an average of 3 times more than the control group.

In the end all participants were asked to rate their experience with the CreditBoost app. Those with the gamified version rated the app 4.5/5 stars on average, whereas the control group rated the existing CreditBoost app 3.9/5 stars on average.

Highlights from the mockups:

The results

The gamified version of the CreditBoost app helped participants improve their credit scores more than the control group. In the end the study found that those who used the gamified experience improved their credit scores by an average of 50 points, while the control group only improved their credit scores by an average of 10 points.

In addition to the increase in credit score, the study participants with the gamified version of the app also did significantly better on tests about credit health knowledge. The average score for those using the gamified version was 84% while the control group had an average score of 63%.

Engagement was also higher amongst participants that used the gamified version of the app. They opened the app an average of 3 times more than the control group.

In the end all participants were asked to rate their experience with the CreditBoost app. Those with the gamified version rated the app 4.5/5 stars on average, whereas the control group rated the existing CreditBoost app 3.9/5 stars on average.